Ethereum (ETH) Price Analysis – Was That A Bullish Breakout?

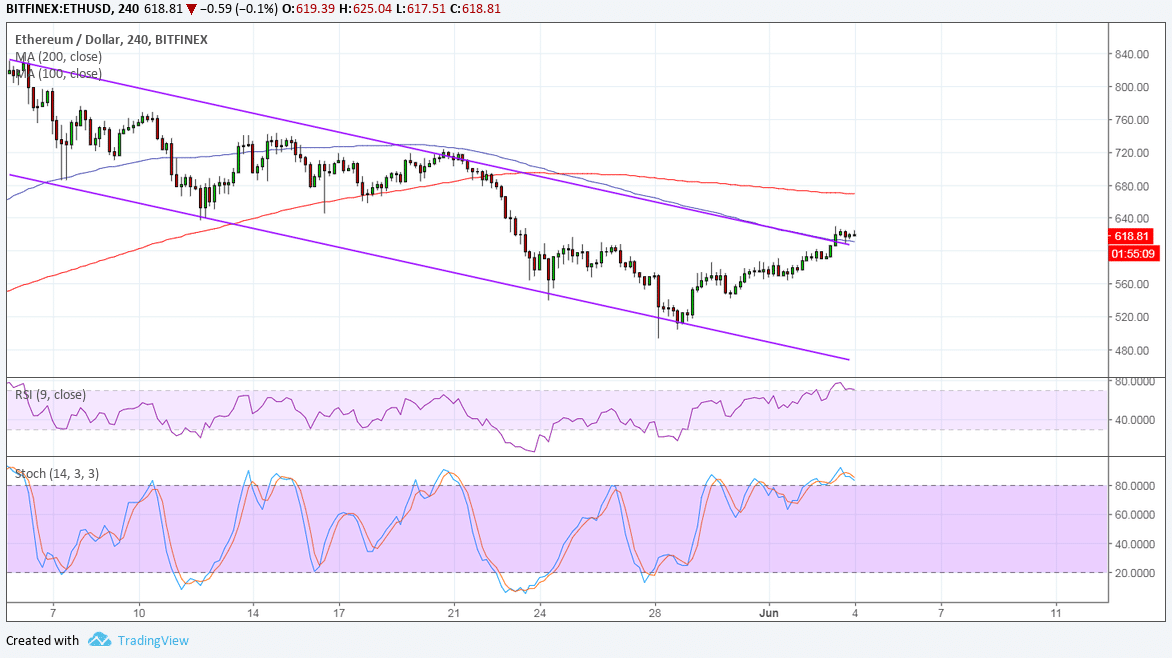

Ethereum appears to be breaking above its channel top to signal a reversal.

Ethereum had been trending lower inside a descending channel on its 4-hour time frame, but a breakout appears to have taken place. This signals that a reversal is imminent, but price might need to clear a few more hurdles to confirm this.

The 100 SMA is still below the longer-term 200 SMA to signal that the path of least resistance is to the downside. In other words, the downtrend is still more likely to resume than to reverse.

The gap between the moving averages is widening to reflect strengthening bearish pressure. However, price has also broken past the 100 SMA dynamic resistance to signal a pickup in bullish momentum. Ethereum might still need to move past the 200 SMA dynamic inflection point to confirm that an uptrend is underway.

However, RSI is already indicating overbought conditions to show that sellers could still return and push price back inside the channel. Stochastic is also in the overbought zone to reflect exhaustion among buyers, and turning lower could bring sellers back in.

The rebound in cryptocurrencies late last week contributed to a strong rise in ethereum price, but it remains to be seen if the rallies can be sustained. Month-end flows were also pinpointed as a factor leading to the climb, although it’s still worth noting that the market capitalization increased from $304 billion from the end of May to $350 billion over just three days.

In an OmiseGO AMA session, Ethereum founder Vitalik Buterin explained how the network will be able to process 1,000,000 transactions with the solutions of Plasma and Sharding.

It also helped that the dollar was unable to draw much support from stronger than expected NFP data as trade war concerns appeared to dominate its price action. There are no major reports due from the US economy so trade-related headlines could influence dollar behavior and draw enough risk flows back to alternative assets like altcoins.

Author : Rachel Lee On Jun 4, 2018

Posted by David Ogden Entrepreneur

David https://markethive.com/david-ogden