Monero Price Up 15% as World’s Largest Cryptocurrency Exchange Prepares Integration

Monero, the world’s second largest anonymous cryptocurrency, is up 22 percent again today, on August 26.

For many years, Monero has been regarded as one of the few cryptocurrencies that is highly legitimate, backed by an experienced and talented development team. It had no pre-sales or controversial mining deals for its miners. The Monero development and community have shown unity since it forked off from Bytecoin, with almost all of its hard forks executed without any contention amongst developers, community members, industry and miners.

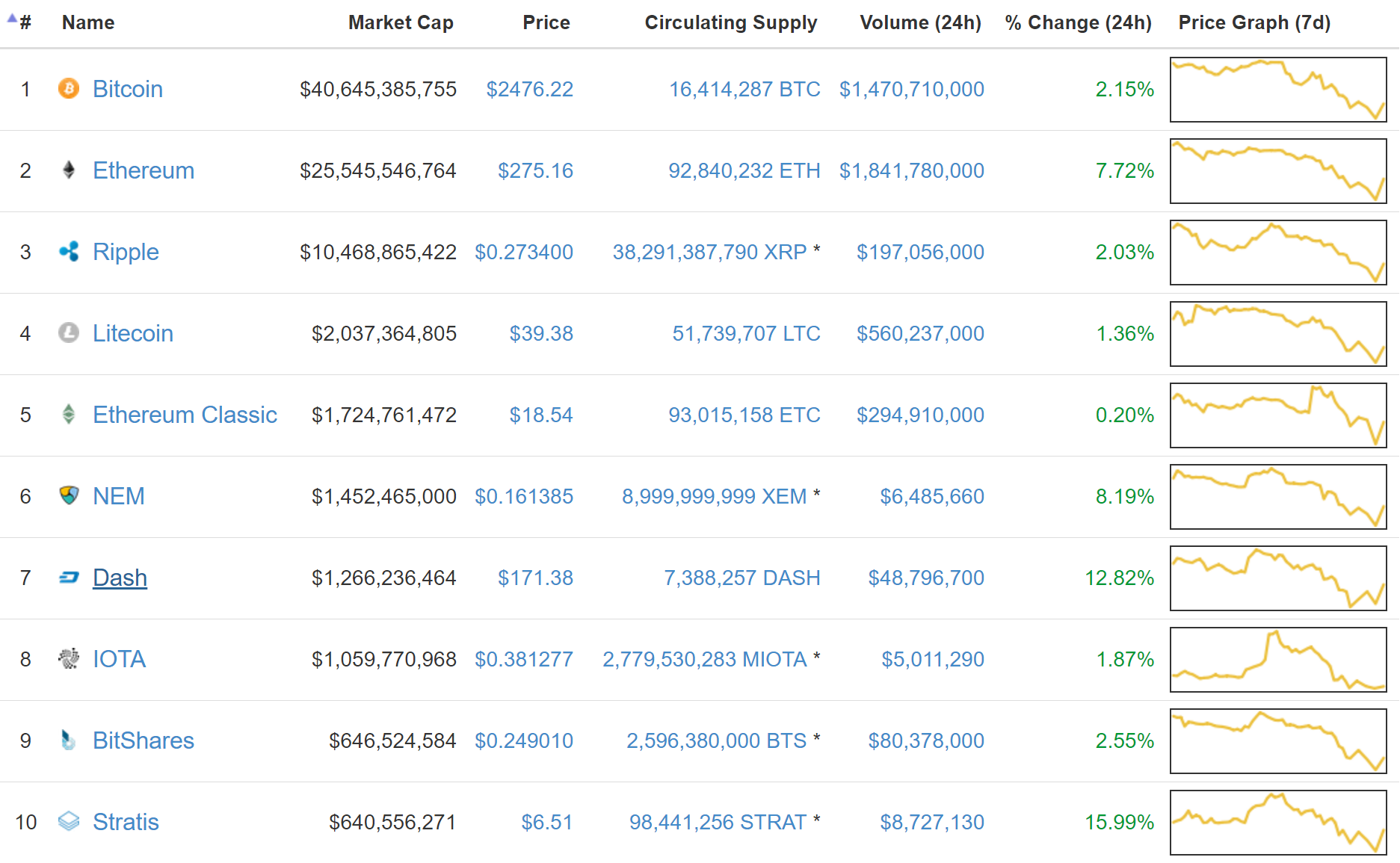

Yet, it has struggled to see an increase in its value. It was pushed out of its top 10 largest cryptocurrency spot and was overtaken by Dash, another anonymous cryptocurrency. A large factor of Monero’s struggle in obtaining an active consumer base and trading market has been the lack of support from large-scale trading platforms and wallets.

Dash for instance, despite its controversial pre-sale and negative reputation, was remained as the world’s seventh largest cryptocurrency for many months due to the support from Jaxx and leading exchanges.

This week, Bithumb, South Korea’s leading bitcoin exchange and the world’s largest cryptocurrency exchange, is about to provide the push Monero has long needed. Bithumb is set to list Monero in its cryptocurrency trading platform tomorrow, on August 27. Because it handles around $700 million worth of trades on a daily basis, the integration of Monero by Bithumb is expected to be an immediate and drastic increase in liquidity for Monero traders, users and investors.

Starting August 23, when Bithumb began to accept deposits from Monero traders, the price of Monero surged, even before the exchange fully listed the cryptocurrency. Tomorrow, as Bithumb completes its last phase of integration and opens Monero trading, the price of Monero will likely surge once again.

Monero was able to rise by 22 percent earlier today due to upward momentum supported by Bithumb and optimistic traders in Asia. So far, every cryptocurrency released or introduced by Bithumb to the South Korean cryptocurrency exchange market has seen a drastic increase in value and trading volume. Ethereum, Ethereum Classic, Ripple and Litecoin have all seen rapid increase in value after being listed by Bithumb and Korbit, two largest exchanges in South Korea.

More importantly, the South Korean exchange market and its traders are highly attracted to cryptocurrencies that have special attributes. For instnace, South Korean traders are keen on Ethereum due to its smart contract-based protocol and flexible ecosystem. The anonymity of Monero will likely attract many investors on the Bithumb platform and if it is well accepted by the South Korean market, Monero could make its way back to the top five cryptocurrencies. Already, it has surpassed Zcash and many other cryptocurrencies to become the tenth largest cryptocurrency in the market.

Author Joseph Young 12:36 am August 26, 2017

Posted by David Ogden Entrepereneur

David https://markethive.com/david-ogden